Vermont offers residents and businesses clean energy incentives to install solar panels and invest in clean energy vehicles.

In combination with federal tax credits for green energy, the cost of any new equipment installed can qualify.**

TAX INCENTIVE NOTICE*

**Fraud Alert**

US Green Energy

Click Here to Sign Up for Free Solar Panel Installation

| Schedule | Acceptance Date | Last Day To Register |

|---|---|---|

| Q1 | Monday January 1, 2024 | March 30, 2024 |

| Q2 | Monday April 1, 2024 | June 30, 2024 |

| Q3 | Monday July 1, 2024 | September 30, 2024 |

| Q4 | Tuesday October 1, 2024 | December 30, 2024 |

| Q1 (2025) | Wednesday January 1, 2025 | March 30, 2025 |

Vermont Regulated Utilities

National Rural Electric Cooperative Association

PLEASE NOTE: Beginning in 2025, the federal tax incentives for solar residential installation will be impacted. See the table below for the dates and amounts currently legislated.

**The Federal tax credit is available every year that new equipment is installed.

Clerk of the Commission

112 State Street

Montpelier, VT 05620-2701

(802) 828-2358

Email the Clerk │Office Location and Parking

Public Records Database and PUC Records Officer Contact Information

[email protected]

Hours: M-F 9:00am – 5:00pm, subject to change

Green Mountain Power

163 Acorn Lane

Colchester, VT 05446

(888) 835-4672

[email protected]

State of Vermont Department of Public Service

112 State Street, Third Floor

Montpelier, VT 05620-2601

(802) 828-2811

[email protected]

Hours: M-F 9:00am – 5:00pm, subject to change

Burlington Weather Bureau

1200 Airport Drive

South Burlington, VT

(802) 862-2475

[email protected]

Clean Energy and Vehicle Federal Tax Credits

Business Federal Tax Credits

State Tax Credit and Rebate Schedule

| Year | Credit Percentage | Availability |

|---|---|---|

| 2024-2032 | 30% | Individuals who install equipment during the tax year |

| 2033 | 26% | Individuals who install equipment during the tax year |

| 2034 | 22% | Individuals who install equipment during the tax year |

| Sales Tax Exemption | Approx. $1000 | Sales tax is exempt on specific solar equipment |

| Solar Capacity Tax Exemption | Approx. $300 | Upgraded property value tax is exempt (see details below) |

If you have determined that you are eligible for the green energy credit, complete Form 5695 and attach to your federal tax return (Form 1040 or Form 1040NR).

IRS Form 5695

Instructions

Future Due Dates and Basics

Office of Energy Efficiency & Renewable Energy

Forrestal Building

1000 Independence Avenue, SW

Washington, DC 20585

RESIDENTIAL CLEAN ENERGY TAX CREDIT

Vermont Department of Public Service

Electric

E Energy

Clean Energy Smart Grid

Renewable Energy Reports

Clean Energy Development Fund

Solar For All

Renewable Energy Standards

Power Outage Map

Energy Office

Brian Sewell

State Energy Program Manager

Phone: (802) 622-4291

Email: [email protected]

Chris Leppla

State Energy Management Program—Coordinator

Phone: (802) 461-9767

Email: [email protected]

Megan Fuller

Municipal Energy Resilience Program—Grant Administrator

(802) 798-4612

[email protected]

133 State St, 5th Floor

Montpelier, VT 05633

Vermont Solar Energy Overview

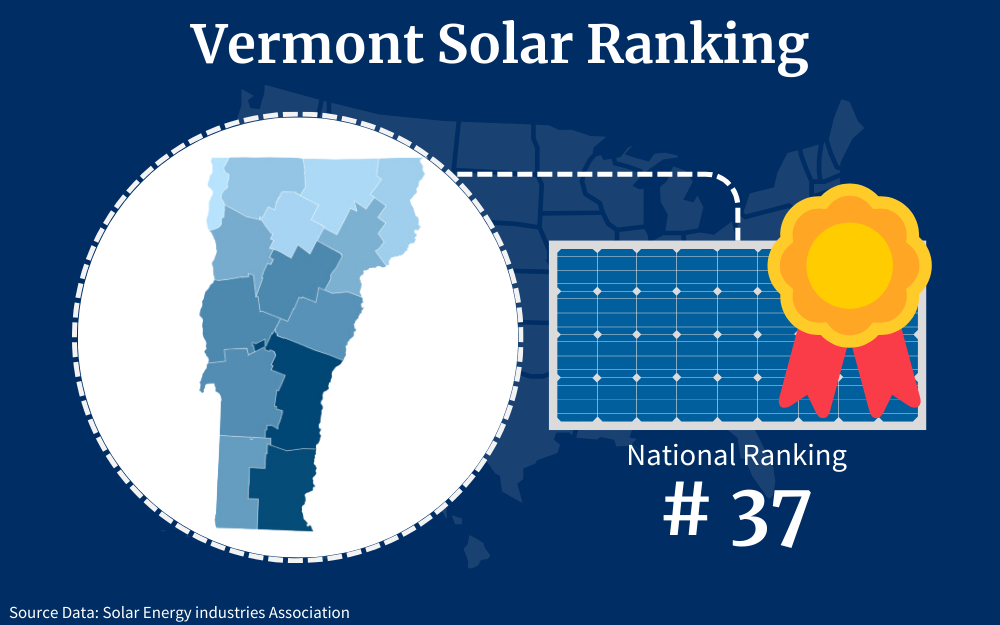

Ranking only 37th in the nation for solar adoptions, Vermont aims to generate 75 percent of its energy from renewable sources by 2032 and is offering various Vermont solar incentives in order to realize these ambitious clean energy goals.

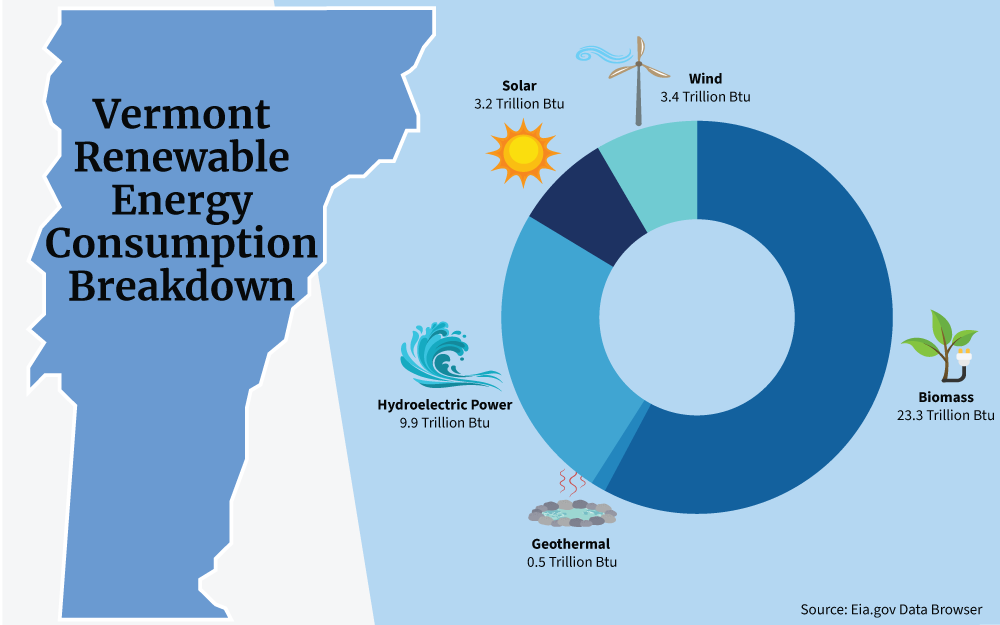

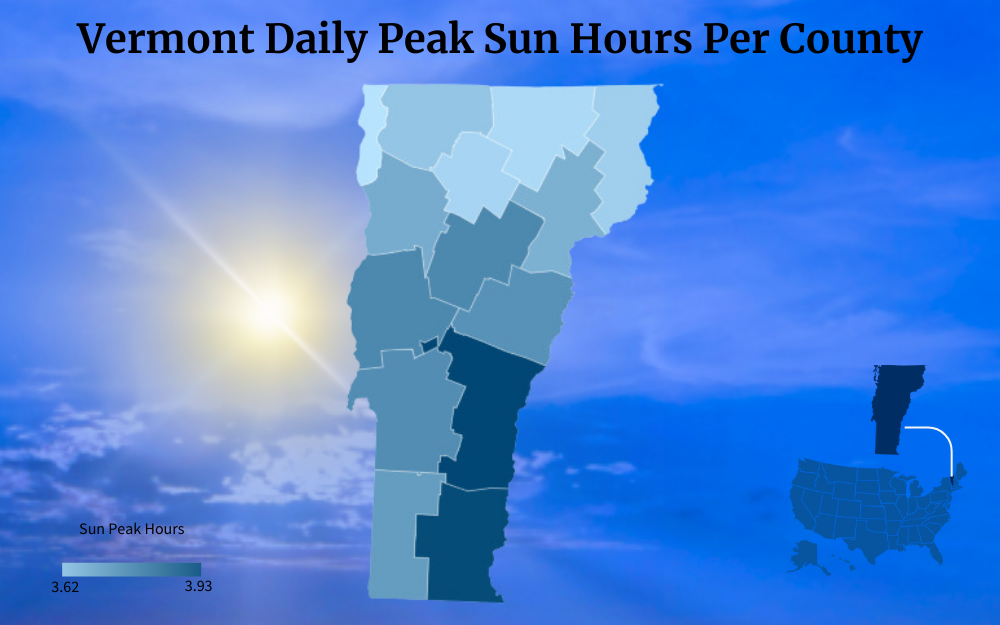

Although Vermont experiences fewer sunny days than other states, the roughly 167 sunny days annually are more than enough for you to realize significant savings on your energy bills when Vermont solar incentives are utilized.

This guide explains all the solar incentives available for Vermont residents, including how state and federal solar tax credits, property tax exemptions, net metering policies, and other programs can reduce the cost of buying solar panels.

You will learn their eligibility requirements, program details, and step-by-step instructions on applying for each solar perk as well as tips on how to combine the different incentives so as to go solar for less.

With your Vermont electric rates significantly higher than the U.S. average,7 installing solar panels in your home is a smart investment. Therefore, tap into these incentives, and you could recoup your investment in under eight years while securing low, predictable energy bills for decades.

Understanding Vermont Solar Incentives and Options

Currently, the Green Mountain State, with its rolling slopes and forested hills, generates roughly 19% of its energy from the sun and ranks relatively well for solar adoption in the country.4

However, although the cost of going solar in Vermont is declining, it is still considerably steep at $17,000 to $20,000 for an average home system. This is where Vermont solar incentives swoop in to slash your costs for going solar.

Vermont offers numerous tax credits, exemptions, rebates, and other solar incentives to lower the cost of installing photovoltaic (PV) panels on your home. Here are some of the main programs that can help you afford clean, renewable solar power:

- Federal Solar Investment Tax Credit (ITC): This is a 30% tax credit running through 2032 that will slash 30% of the total cost of your solar system off your federal tax bill. The average credit value is $5,166 in Vermont.

- Renewable Energy Systems Sales Tax Exemption: Vermont will exempt 100% of state sales tax on the solar equipment you purchase for your home system. With taxes at 6%, this will save you approximately $1,000 on the typical installation.

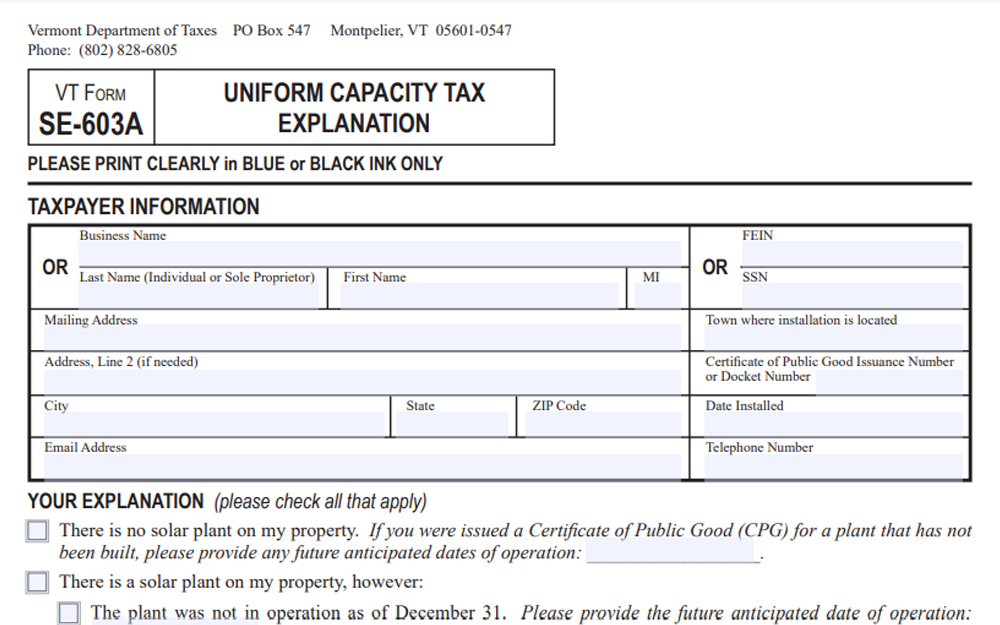

- Uniform Capacity Tax and Exemption for Solar: This prevents an increase in property taxes on the added value and power solar panels will give to your home which is approximately a 4.1% increase in value. You will save up to $320 per year.

- Net Metering: Utility companies will give you bill credits at retail electricity rates for 100% of your solar energy production. You can offset your electric bill and even earn income.

- Local Incentives: Some utility companies like Green Mountain Power offer solar battery rebates up to $10,500 through its Bring Your Own Device program.

- Expedited Permits for Rooftop Solar: Faster permitting will help you connect your solar system to the grid for net metering bill credits quicker and more easily.

Federal Solar Credit Overview

The Federal Solar Investment Tax Credit (ITC) is the most impactful incentive you will find for going solar in Vermont and across the U.S.6 Here are the key details on how the credit works and what it covers:

What Is the Federal Solar Tax Credit?

The ITC is a 30% tax credit that will offset the costs of installing solar panels and all related equipment on your home before December 31, 2032.

If you have a $20,000 solar installation, a $6,000 credit (30% of total costs) will directly reduce what you owe on federal taxes for the year dollar-for-dollar.

Now comes the question: “What happens If the tax credit is more than I owe, will I get a refund?”

If your tax liability for the year is lower than your credit, the remainder will rollover year after year until it is finished or for up to 5 more years.

What Does the Federal Solar Tax Credit Apply To?

The ITC covers 30% of the total “qualified solar electric property expenditures” including:

- Solar panels and mounting equipment

- Inverters, transformers, wiring, and other electrical components

- Energy storage systems linked to solar (though limited to 26% of costs for stand-alone storage)

- Labor, permitting fees, professional services, and sales taxes related to the system

Who Qualifies for the Federal ITC?

To qualify for the ITC, you need to own the solar energy system and have it installed on your primary or secondary U.S. residence. The solar system must also be new and not upgraded or repurposed; surplus solar panels are not eligible for the program.

Additionally, you cannot claim the ITC if you lease or enter into a power purchase agreement (PPA) for solar, as you do not directly own the system.

How Do I Claim the 30% ITC?

To claim the ITC, you need to wait until the next tax season for the year in which your solar is installed and becomes operational in order to claim the tax credit on your IRS tax return for that year. Follow these steps:

- Fill out the federal solar tax credit form or IRS Form 5695 and attach your installer’s details,3 your total system costs with invoices and receipts to support, as well as purchase dates and specifications of your solar system.

- Include the completed form with your standard 1040 tax return

- Claim the tax credit amount listed on Form 5695 on Line 5 of your 1040

- Submit your taxes as normal

The ITC will directly reduce how much you owe the IRS for that tax year. There’s rarely an issue, but double-check your return to confirm the 30% credit was applied correctly.

The ITC Is a Must-Use Federal Solar Incentive

The 30% federal tax credit should be your first stop when considering Vermont solar incentives. It provides unrivaled savings, and the application process is easy and straightforward with minimal paperwork.

Just be sure your tax liability exceeds the credit amount. If not, roll over the unused portions annually for up to 5 more years until you use up the full value of the credit.

This program has helped thousands of homeowners like you in solar adoption nationwide.

Other Solar Incentives Available to You in Vermont

16% of Vermont’s in-state electricity net generation came from solar installations in 2021.11 This is already an impressive number, but the state is still pushing for more of its residents to switch to solar.

Beyond the federal solar tax credit, Vermont also offers additional solar incentives to reduce your cost of switching to solar power and to make the process easier.

Renewable Energy Systems Sales Tax Exemption

Vermont will provide you with a full sales tax exemption on all your solar equipment purchases and installation labor expenses.

With state sales tax at 6%, this will save you around $1,030 on typical residential solar systems. The exemption takes effect automatically at the point of sale, so you do not need to run up and down filling and submitting paperwork.

Here are the key details you should know about the solar sales tax exemption in Vermont:

- It covers 100% of the state sales tax normally charged on solar equipment as well as the installation costs.

- The exemption applies to both solar photovoltaic (PV) systems and solar water heating systems.

- All Vermont residents purchasing a new solar energy system can receive the sales tax exemption.

- The 6% savings will already be applied to any quotes you get from state-licensed solar installers.

This automatic 6% tax exemption is a straightforward incentive you get just for going solar in Vermont. And every little bit helps offset your solar power system costs.

Uniform Capacity Tax and Exemption for Solar

Typically, as with any home improvement project, installing a solar system in your home will increase the taxable value of your property. Additionally, in Vermont, if your property has an energy-generating system, you are subject to three types of property taxes:

- The Uniform Capacity Tax which requires you to pay $4 for every kW of your system capacity annually

- The Municipal Property Tax

- The Education Property Tax to help fund schools in Vermont

However, Vermont’s Uniform Capacity Tax and Exemption for Solar prevents your property taxes from going up due to the addition of a home solar energy system.5

Additionally, the program waives the statewide education property tax, as well as municipal and uniform capacity taxes on PV systems up to 50 kW in size. Larger systems may still incur partial property taxes.

Based on the $320 per year average avoided property tax increase in Vermont, this incentive could give you over $6,000 in savings over approximately 25 years, the average lifespan of solar panels.

To apply for the Vermont property tax exemption, you will need to fill out Form SE-603A (Uniform Capacity Tax Explanation).8

After that, this exemption will take effect automatically after your installation. You will simply see a lack of property tax hike on your next assessment while your property value rises.

This tax exemption provides you with peace of mind knowing that your property taxes won’t rise because of your solar investment.

Local Vermont Solar Incentives

Although Vermont lacks statewide solar cash rebates, some utility companies offer individual incentives for their customers. The main local solar program comes from Green Mountain Power’s Bring Your Own Device Program.

Green Mountain Power (GMP) services three-quarters of Vermont residents. Under its Bring Your Own Device (BYOD) program,1 GMP will offer you a solar battery rebate of up to $10,500 if you share your stored solar energy with the grid during peak events.

GMP provides the following upfront solar battery rebates:

- $850 per kW of battery capacity for 3-hour daily discharge enrollment

- $950 per kW of battery capacity for 4-hour daily discharge enrollment

An additional $100 per kW bonus will apply if you live in a high-need area on the grid. Retrofitting an existing solar array with battery storage will net you the regular per-kW rates plus the $100 bonus.

BYOD-approved battery choices include;

- Tesla Powerwall

- Sonnen Battery

- Emporia Alpha-ESS

- Enphase IQ Battery

- SolarEdge StorEdge Compatible Systems

- Generac PWRcell systems

You are free to use any certified solar installer when installing the battery storage.

To take part in the BYOD program, you will need to sign up through the Green Mountain Power website.2 The full battery rebate comes as an upfront discount on your purchase price.

The program also allows you to earn bill credits when you share stored power with GMP through net metering.

If you are a customer of Vermont’s largest utility, Green Mountain Power, this is a stellar incentive to install solar batteries. Earning up to $10,500 upfront plus ongoing bill credits means you will realize faster payback on your home energy storage investment.

Does Vermont Offer Net Metering and Power Purchase Agreements (PPA)?

Yes. Vermont offers net metering and power purchase agreements (PPAs). Here’s how each arrangement works.

Net Metering (NEM) in Vermont

Net metering allows you to send excess energy that is produced by your solar panels and not used in your home to the grid. In turn, this earns you credits on your electricity bills that you can claim if you ever need to pull electricity from the grid.

A net meter tracks your power inflows and outflows and thus you only get charged for the balance in case of any.

![Illustration showing that there are 49 total number of solar plants in [state] at the time this article was written.](https://vermont.statesolar.org/wp-content/uploads/sites/46/2023/09/Vermont-Solar-Plants.png)

Vermont’s net metering policy is one of the best in the country.10 The Vermont Public Service Commission (PSC) requires that all public utilities purchase any excess energy produced by your solar panels at a ‘blended residential rate’ which is just about the retail value.

As such, nearly all utilities in Vermont must offer net metering for solar systems up to 500 kW at a statewide value of around $0.17 per kWh credit. This is close to the state’s average retail electricity rate which means that for every kWh you sell to the grid, you can pull almost 1 kWh for free.

Additionally, you and other Vermont residents can form “solar groups” to share credits from a communal net-metered system.

Enrolling in net metering simply involves contacting your utility once your solar installation is complete to confirm that you have a bidirectional electric meter installed and to interconnect your system to the grid. If the meter is not already installed, you should be able to get one for free.

This policy will help you maximize savings over decades of owning the solar system.

Power Purchase Agreements (PPAs)

What if you cannot afford to raise any down payment for switching to solar? Are you forever locked away from enjoying the benefits of solar in Vermont?

Thankfully, no. With a PPA, you pay a fixed rate for “solar-as-a-service” from an installer who installs and owns your rooftop system at no cost.

This $0 down arrangement allows you to access solar savings without upfront costs.

However, you don’t own the system. As such, you will miss out on tax credits.

Twenty-year contract lock-ins can also be a drawback for some people. However, PPAs are a great way to switch to solar if you can’t purchase the system outright or you do not want to take a solar loan.

How Can I Apply for Solar Tax Credits in Vermont?

Here are the steps for tapping into Vermont solar incentives and tax credits:

Federal Solar Investment Tax Credit

You must own (not lease) your solar system to qualify for the 30% federal ITC. To claim:

- Install your system and obtain documentation on all equipment and installation costs from your solar company.

- Next tax season, complete IRS Form 5695 with your installer’s details, system costs, and purchase dates.

- Include the finished IRS form when you file your standard 1040 tax return.

- Claim the ITC amount from Form 5695 on Line 5 of your 1040.

- Submit your completed tax return.

Renewable Energy Systems Sales Tax Exemption

You do not need to take any action. This 6% credit applies automatically when you are quoted for and buy a solar system.

Uniform Capacity Tax and Exemption for Solar

You also don’t need to take any action here. Your property taxes will not increase due to solar under this program.

Fill and submit Form SE-603A – Solar Energy Capacity Tax Explanation.9 After that, this exemption will take effect automatically after your installation and you will not have to pay an extra cent on your property taxes.

Local Incentives

For Green Mountain Power’s BYOD solar battery rebate, visit the utility’s website to sign up and enroll your new/existing solar system.

Net Metering

Once your solar installation is complete, your chosen solar company will submit the interconnection application on your behalf to your utility company in order to activate net metering bill credits.

What Materials and Parts Do You Need for Solar Panel Systems?

Installing solar panels is a complex undertaking. It involves more than just laying some solar panels on your roof.

Here are the typical components that go into a complete Vermont house solar system:

Solar Panels

The solar panels lie at the heart of your solar system. A panel or solar board is made of several photovoltaic cells that absorb and convert sunlight into direct current (DC) electricity.

Vermont solar installers typically recommend purchasing tier 1 panels from leading brands that will offer you 10 to 25-year warranties.

The cost of solar panels in Vermont is around $2 to $4 per watt depending on panel efficiency, size, and quality.

Inverters

Inverters transform the DC output from your solar panels into 240-volt alternating current (AC) used to power your home appliances. Microinverters on each panel are more optimal for power conversion but at a higher cost, while central inverters cost less.

Expect to invest around $0.25 to $0.40 per watt of your overall system size on a quality inverter.

Mounting Equipment

Items like racks, brackets, and hardware are important for securely attaching your solar array to your home’s roof. Flush mounts tend to have simpler mounting that costs less than tilt systems.

Plan for $1 to $3 per watt in mounting costs for a residential solar installation.

Electrical Accessories

Wiring, conduits, junction boxes, breakers, connectors, and other electrical parts safely deliver the power your panels produce to your home’s electrical system. Most Vermont homes spend $1,000 to $2,000 on electrical solar components.

Batteries

Many people ask, “How long can solar panels last without sun?” But that really isn’t something you should worry about.

Pairing solar panels with batteries lets you store energy for use anytime, especially when you need it at night or during winter when sunshine is scarce. Battery prices have fallen recently, but still expect to pay around $7,500 for a decent size 10 kWh home battery that can support 5 to 10 hours of backup.

Programs like GMP’s Bring Your Own Device (BYOD) Program can allow you to add battery storage to your solar system for less.

Monitoring

Monitoring your solar energy production, consumption and other system metrics can help optimize your investment. Basic monitoring costs around $500 to $1,500 plus data fees.

More advanced alternatives will run you higher but will provide greater insight.

For a typical 6 kW solar panel system, most Vermonters pay around $17,000 to $22,000 before incentives. But incentives can shrink your out-of-pocket cost by thousands.

How To Calculate How Many Solar Panels You Need

Figuring out the ideal number of solar panels to meet your household’s electricity usage without oversizing or undersizing your system starts with running the numbers. A solar calculator makes modeling array size, energy output, and bill savings easy.

Good solar calculators ask a series of questions about your home, your current energy consumption, and savings objectives to estimate your solar panel needs:

- Location. Your site-specific weather, sunlight hours, utility rates, and incentives inform output and savings estimates.

- Energy Demands. Ballpark your energy needs based on your typical Vermont home electric use then adjust higher or lower to meet your projected consumption.

- Roof Factors. Your roof orientation, pitch, shading, and area limit how many panels you can fit and their sun exposure.

- Equipment. The efficiency of your solar panels and inverters impacts production projections and pricing.

- Financials. Comparing system costs against utility savings forecasts your ROI timeline for solar investment payoff.

Advanced calculators simulate hour-by-hour solar production based on the arc of the sun across your specific home’s roof. This helps estimate both how much electricity your system can generate in a year and the bill savings.

Armed with your solar calculator outputs, you can then determine the ideal solar panel system size for your home’s needs and budget.

If you buy too small, you will not offset enough of your usage. If you buy too large, your payback period will increase significantly.

A good calculator will allow you to adjust all the inputs and also explain its mythology so you can maximize your financial outcome.

With smart modeling, your panels will produce enough clean energy to slash your electric bills for decades to come and even earn you an income.

Where To Buy Solar Panels in Vermont

Solar installation is a booming business across the country which naturally breeds unscrupulous firms. With so many new solar companies entering the industry every year, it is important to make sure that you select an experienced local installer/retailer in Vermont.

Here are some tips to help you find the best solar partner:

- Read online reviews and ask your neighbors in Vermont for installer referrals.

- Confirm your company of choice has been in business for 5+ years and has deep roots in Vermont.

- Ask for a portfolio of past work and examples of installations similar to yours.

- Look for certifications from NABCEP and a long history of top ratings on ratings websites

- Get quotes from 3-5 installers to compare pricing and offerings.

- Inspect warranties on equipment and workmanship. Look for 10-year minimum inverter warranties and 25-year panel warranties.

- Review your chosen installer’s BBB profile and licensing to validate their reputation.

- Pick a company that provides a full-service experience: assessment, equipment supply, permitting help, installation, monitoring, maintenance, and support.

When choosing who to purchase solar panels from in Vermont, select trusted local solar experts to ensure your project goes smoothly from permitting to activation.

Solar Energy and the Environment

Right now, there are 49 solar plants in Vermont that help generate electricity for the state. This number is likely to grow exponentially as the push for solar energy continues.

But as an individual exploring alternative energy sources not only to save bucks but also to save the earth, it is understandable that you would be concerned about their impact on the planet. You might be asking questions like: “Is solar energy really clean?” or “Are solar panels bad for the environment?”

Well, solar power in itself is green energy. Meaning it does not produce harmful gases that could cause pollution unlike traditional sources of energy that the world is used to utilizing.

However, there can be one factor that could make people question why solar energy is bad. And it could happen at the end-of-life of your solar system.

Since the panels are still made of metals and materials that could be considered hazardous waste, they must be disposed of properly after their lifetime (usually around 25 to 30 years). To mitigate the harm though, a lot of companies and institutions actually recycle most of the parts.

Nevertheless, the pros definitely outweigh the cons or what you may consider bad things about solar energy. And there is no better time to switch to it than now in Vermont!

The state offers several incentives to make solar power in Vermont more affordable and accessible. The federal tax credit, automatic state exemptions, and utility-specific programs like Green Mountain Power’s battery rebates help defray the cost of switching to solar for Vermont homeowners.

Make sure to run the numbers using a solar calculator tailored to Vermont’s electricity rates, sunlight, and solar policies before installing a solar system on your home.

If your long-term savings are worth the investment, connect with a local solar installer to evaluate your home’s potential. Leverage their expertise along with available Vermont solar incentives, and you can unlock decades of clean, low-cost power from the sun.

Frequently Asked Questions About Vermont Solar Incentives

Can I Get Free Solar Panels in Vermont?

Unfortunately, there are currently no incentives that can help you obtain completely free solar panels in Vermont, so be wary of offers, especially those that say ‘free solar panels for seniors’ as they target unassuming elderly people. However, the 30% federal tax credit plus state sales and property tax exemptions significantly defray your solar equipment purchase and installation costs, and financing options like PPAs can also provide you with zero money down solar.

How Long Does It Take To Pay Off Solar Panels in Vermont?

Most solar panel systems in Vermont take 6 to 9 years to pay for themselves through energy bill savings. This payback timeline benefits from net metering credits and solar incentives lowering your upfront costs.

Do Solar Panels Work Well in Vermont With Limited Sunlight?

While Vermont only gets around 167 sunny days per year on average, modern solar panels can still harvest ample sunlight to generate significant savings. Just be sure your solar installer helps optimize factors like roof direction, pitch, and panel efficiency to maximize production.

References

1Green Mountain Power. (2022). Bring Your Own Device. Green Mountain Power. Retrieved September 14, 2023, from <https://greenmountainpower.com/rebates-programs/home-energy-storage/bring-your-own-device/>

2Green Mountain Power. (2022). BYOD Sign-up Form. Green Mountain Power. Retrieved September 14, 2023, from <https://gmp.virtualpeaker.io/#/signup/byod>

3Internal Revenue Service. (2022). Residential Energy Credits. IRS. Retrieved September 14, 2023, from <https://www.irs.gov/pub/irs-pdf/f5695.pdf>

4Solar Energy Industries Association. (2023). Vermont Solar. SEIA. Retrieved September 14, 2023, from <https://www.seia.org/state-solar-policy/vermont-solar>

5State of Vermont. (2023). Solar Plants Subject to the Uniform Capacity Tax. Vermont Department of Taxes. Retrieved September 14, 2023, from <https://tax.vermont.gov/municipal-officials/solar-plant-taxation>

6U.S. Department of Energy. (2023, March). Homeowner’s Guide to the Federal Tax Credit for Solar Photovoltaics. Energy.gov. Retrieved September 14, 2023, from <https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit-solar-photovoltaics>

7U.S. Energy Information Administration. (2023). Electric Power Monthly. EIA. Retrieved September 14, 2023, from <https://www.eia.gov/electricity/monthly/epm_table_grapher.php?t=epmt_5_6_a>

8Vermont Department of Taxes. (2022, August). Form SE-603A (Uniform Capacity Tax Explanation). Vermont Department of Taxes. Retrieved September 14, 2023, from <https://tax.vermont.gov/sites/tax/files/documents/SE-603A.pdf>

9Vermont Department of Taxes. (2023). Form SE-603A. Vermont Department of Taxes. Retrieved September 14, 2023, from <https://tax.vermont.gov/content/form-se-603a>

10Vermont Public Utility Commission. (2023). Net-Metering. Vermont Public Utility Commission. Retrieved September 14, 2023, from <https://puc.vermont.gov/electric/net-metering>

11U.S. Energy Information Administration. (2023). Vermont State Profile and Energy Estimates. EIA. Retrieved September 14, 2023, from <https://www.eia.gov/state/analysis.php?sid=VT>

12Vermont Law School Solar Panel Array Photo by SayCheeeeeese / CC0 1.0 Universal (CC0 1.0) Public Domain Dedication. Cropped, Resized and Changed Format. From Wikimedia Commons <https://commons.wikimedia.org/wiki/File:Vermont_Law_School_Solar_Panel_Array-1.JPG>